is a new roof tax deductible in 2019

Installing a new roof is considered a home improve and home improvement costs are not deductible. Get a tax deductible roof.

Are Roof Repairs Tax Deductible The Roof Doctor

Putting on a new roof is a great investment especially if you install a cool roof.

. For example you can install entrance ramps create modified bathrooms lower cabinets widen doors add handrails and create special doors. The deductions must be considered reasonable and must have a practical use. For most homeowners the basis for your home is the price you paid for the home or the cost to build your home.

Revenue Procedure 2019-08 explains how taxpayers can elect to treat qualified real property as Section 179 property. In the case of property placed in service after December 31 2019 and before January 1 2023 26. However if the cost of the roof didnt increase the homes tax basis you.

Taxpayers should claim the deduction on Schedule E of their tax return and file form 4562 in the year the new roof is put in service. If you pay 10000 for a new roof for your house and your home office takes up 10 of your house. Owning a rental property has certain tax advantages.

These expenses for your main home are not deducible on your tax return. However the irs does not allow full deductions for this type of expense when it is incurred. The Non-Business Energy Property Tax Credits have been retroactively extended from 12312017 through 12312021.

New construction and rentals do not apply. The roof may qualify for an energy saving improvement credit if it meets certain energy saving improvement certification. Is a roof eligible for the residential energy efficient property tax credit.

10 of cost up to 500 NOT INCLUDING INSTALLATION Expires. If your building or facility needs a new roof. Tax deductions like Section 179 grants and rebates and save money on.

The cost of a new roof is an expense investment that most property owners hope they can get some relief from at tax time. Under the law you can get tax deductions from the interest of your home improvement loan given you meet the criteria set by the Internal Revenue Service IRS In this post your residential roofing contractor Jack the Roofer discusses the criteria for a tax deductible home improvement such as a roof replacement. Revenue Procedure 2019-08 explains how taxpayers can elect to treat qualified real property as Section 179 property.

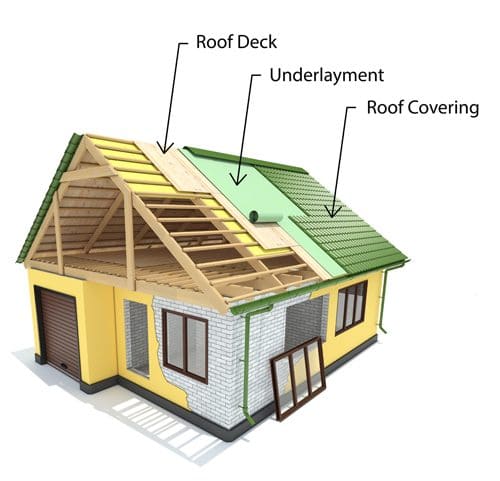

Architectural and aesthetic purposes don. In fact depending on how the property is classified the cost of a new roof may not be deductible as an expense at all. For example if you purchase the home for 400000 and spend 15000 to install a new roof the homes tax basis is 415000.

Tax deductions like Section 179 grants and rebates and saved money on. However home improvement costs can increase the basis of your property. Is there a tax credit for a new roof in 2019.

Most businesses qualify for this deduction but there are limitations. Prior to the December 2017 changes the cost of the roof replacement was depreciated over 39 years. Putting on a new roof is a great investment especially if you install a cool roof.

UPDATED JANUARY 2021. This credit is worth a maximum of 500 for all years combined from 2006 to its expiration. 1 Best answer.

Click to see full answer. A homes tax basis dictates the amount of taxable gain that results from a sale. Of that combined 500 limit A maximum of 200 can be for windows.

The 6 Best Tax Deductions for 2019. The Tax Cuts and Jobs Act approved by Congress in December 2017 under section 179 allows building owners to deduct the full costs of a roof replacement up to 1 million in the year its completed. Suppose your contract price was 20000 and your state sales tax was 6 percent and the contractor charged you 1200 on top of the contract amount.

Installing a new roof is considered a home improve and home improvement costs are not deductible. However the IRS does not allow full deductions for this type of expense when it is incurred. If you get a new roof the section 179 deduction allows you to deduct the cost of it.

See which of these six key tax deductions you can use. However home improvement costs can increase the basis of your property. Get a Tax Deductible Roof.

If you later sell the home for 415000 the total gain is zero. If your roofing contractor charged you sales tax on the entire contract amount then you can claim the sales tax paid to the contractor. June 6 2019 445 AM.

The Internal Revenue Service lets landlords depreciate residential property improvements over a recovery period of 275 years. Installing a new roof is considered a home improvement and home improvement costs are not deductible. Unfortunately you cannot deduct the cost of a new roof.

Unfortunately you cannot deduct the cost of a new roof. But it can be an expensive prospect. September 3 2019 by shannon morton.

You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs. If you get a new roof the Section 179 deduction allows you to deduct the cost of it. These are all improvements that can be deducted through the medical expense deduction.

The entire 1200 is deductible. Must be an existing home your principal residence. In the case of property placed in service after December 31 2022 and before January 1 2024 22.

In general traditional roofing materials and structural. Get a Tax Deductible Roof. But it can be an expensive prospect.

If you decide to completely replace a buildings new roof you can now take an immediate deduction of up to 1040000 in 2020 for the cost of the new roof.

Deducting Cost Of A New Roof H R Block

Is Roof Replacement Tax Deductible Residential Roofing Depot

Can I Claim The Federal Solar Tax Credit For Roof Replacement Costs Westfall Roofing Tampa Sarasota

Pin On Global Warming Notice For Earth S Guardians

Roofing Basics The Tax Credits Explained For Replacing A Roof

Home Buying Tax Deductions What S Tax Deductible Buying A House Tax Deductions Real Estate Estate Tax

Can You Claim A Tax Deduction On Your New Roof Ken Morton Sons Llc

Federal Tax Credits Can Help Sell Roofs Building Knowledge Certainteed S Official Blog

Can Roof Replacement Be Tax Deductible Here Are The Ways

Is Roof Replacement Tax Deductible Residential Roofing Depot

7 Home Improvement Tax Deductions Infographic Video Video Tax Deductions Tax Write Offs Deduction

Is Roof Replacement Tax Deductible Residential Roofing Depot

Guide To Expensing Roofs Expense V Capitalization Section 179 D

Irs Tax Forms Infographic Tax Relief Center Video Video Small Business Tax Deductions Business Tax Deductions Small Business Tax

Are Roof Repairs Tax Deductible B M Roofing Colorado

Roofing Basics The Tax Credits Explained For Replacing A Roof

Are Metal Roofs Tax Deductible

6 Things You Need To Know Before Starting A New Roof Installation

Florida Raises The Roof On Skyrocketing Home Insurance Costs Forbes Advisor